Before we look at how to make money in NFTs (and there is a lot of money to be made), let's take a look at how not to do it.

How to lose $2 600 in less than a minute.

I had worked tirelessly and my bot had made some incredible trades. I was looking to blow off some steam, so I prepared some food, cracked open a beer, and put on a movie. During the movie, I got an idea. I went to the office, made some changes to the bot, and ran it. One minute later I saw some numbers that made my blood run cold.

In my confidence I and the slight buzz from the alcohol I had missed a decimal point and set my bot to bid 0.85 ETH instead of the intended 0.085 ETH. Before I stopped it my bot had made over 600 bids. Oh no. A very lucky individual who was the first to see the bot going haywire accepted one of the bids, earning them a nice profit amounting to more than the annual salary of the average citizen of India.

More people saw my bids and jumped at the opportunity to accept, but since my wallet was already drained they were all (luckily) too late. This was early on in my journey and I had lost nearly all my starting capital.

But I am getting ahead of myself. Let's go back to the beginning.

NFT

This all started with how most good ideas come to life - luck, a healthy dose of coincidence and by scrapping an idea that seemed good at the beginning to start work on a better one.

First, the basics. We need to know what an NFT is, otherwise, the rest of this article won't make any sense. If you're an NFT veteran; congratulations, you can skip ahead.

What is an NFT? What does NFT stand for?

Non-Fungible Token.

Still confused? Yeah, same.

Fungibility isn't a new concept. The money you spend daily, a dollar, for example, is fungible - I give you a dollar, you give me a dollar we'll both have the same as we started with.

A concert ticket, however, is non-fungible. If we traded concert tickets we'd both end up with something completely different. They are unique - and so are NFTs. I give you my ticket to an Elton John concert, and in return, you give me your ticket to Nickelback. We no longer have the same thing we started with, and I will be disappointed. Who would want to listen to Nickelback, let alone see them live?

How do NFTs work?

As a rule of thumb, all NFTs are part of the Ethereum blockchain. Like Bitcoin is a cryptocurrency, so is Ethereum, but it's more. It's a network that supports trading and keeping track of who owns NFTs. Like a new, decentralized, internet. Sort of.

What can an NFT be?

NFTs can be anything that is stored as 1's and 0's. Put easily - everything digital. Music, drawings, a picture of your cat, heck, even this article could be an NFT. However, most of the excitement today is surrounding digital art.

My take on NFTs

I think the concept is interesting, and I believe NFTs can have many use-cases. That being said, the state of market in the digital art world right now is a little silly. Take this collection of Taco Bell Tacos sold for a grand total of $69 million.

But to me, these tacos make one thing clear. There is money in NFTs. Lots and lots of money. I don't know about you, but that interests me.

How it all began

Let's go back to the start. A while back a colleague and I decided to get into the Web3 space. We had the idea to create a Norwegian platform on which to trade NFTs. We both taught ourselves the programming language Solidity which is predominately used to implement smart contracts on the Ethereum network. After, I coded up a simple MVP for the frontend of the marketplace. It is still live here, though most of it no longer works due to OpenSea making breaking changes to their APIs.

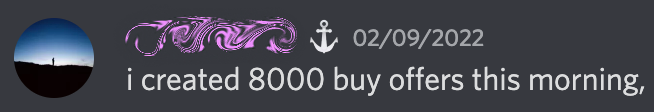

We decided to integrate features from OpenSea (the largest marketplace for trading NFTs) to help kickstart the project. During development, I ran into some issues with OpenSea's API, so, naturally, I went to their Discord to ask for help from their developers. While I was corresponding with them, a message in the chat piqued my interest:

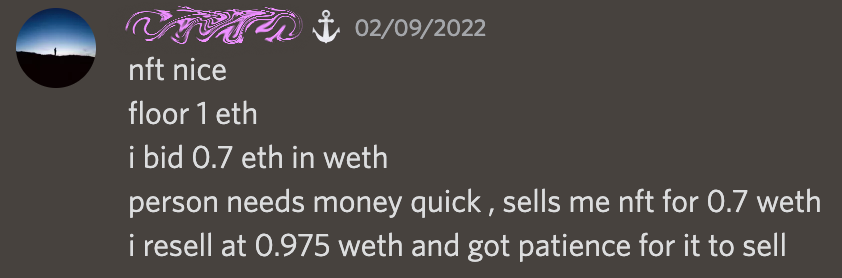

This was an absurd amount of requests. Why was this guy making so many bids at once? I had to know. I asked and the reply I got was the following:

Not the most graceful way to put it, but the idea was solid. It was ingenious as it was simple.

- Find a collection of NFTs

- Bid a little under the floor price (the lowest 'buy now' price of that collection)

- Someone accepts the offer

- You list the NFT you just bought for sale a little under floor price

- Once it sells, you pocket the difference

- Rinse and repeat

Most of the people receiving the offer will probably look at it and roll their eyes. But the 0.1% out there would see the offer as a possibility - a possibility to sell a piece of digital art they sorely did not want anymore. It was a numbers game. And the winner was the one who could code the bot with the fastest bid speed.

The game was on.

Thus began 4 months of work and countless hours of coding. I still had the NFT platform to work on, but as time went on the trading bot became an obsession and my sole point of focus. I shared the idea with my business partner, and he was just as excited as I. That very weekend after many hours of coding I had a working prototype. I ran it for the first time and it managed around 22 bids per minute. It. Was. Slow.

How buying and selling digital art works on OpenSea

Before I can get to the details of making the bot faster we have to know the basics of mass trading digital art. There are quite a few factors to consider: the bidding speed, the amount of concurrent outstanding bids, and, most crucially, the fees.

The economics of digital art are nothing like their physical equivalent.

Let's do a quick mental exercise:

We get into a time machine and travel to a not-so-distant past where Picasso is a starving artist still perfecting his work. He has just finished a fantastic painting, however, he needs to eat, yet he has no money. He can't eat his painting, so he decides to sell it for $100 to a kind fellow on the street. Picasso isn't happy, but at least he goes to bed with a full belly.

We get into our time machine and travel back to the present and Picasso is one of the most renowned artists in human history. That very same painting he sold for $100 to feed himself has sold at auction for $10 000 000. How much of the money does Picasso get from the sale?

None, because he is dead. But were he alive today he would still not see any of the $9 999 900 the painting has appreciated for.

Poor Picasso.

NFTs are different, however. There is a royalty fee attached to the art which the artist decides when publishing. The fee can range from 0%, all the way up to an extreme 10%.

Let's perform the same exercise as before, only now Picasso has released his painting as an NFT and set a royalty fee of 10%. He would still only get $100 on the initial sale, but, years later, when the painting is sold at auction he gets a million dollars just from the royalties. This, including all the other subsequent times the piece changes hands after the initial sale, would make Picasso an obscenely rich man.

But I am getting off-topic. This is not an article to persuade you to become an NFT artist so you can finally buy that yacht and move to Monaco. This is an article about writing code to automate buying NFTs so you can finally buy that yacht and move to Monaco.

The royalty fee

The royalty fee is important to keep in mind when trading. If we buy an NFT for, say 1 ETH, and sell again for the same price, we won't break even, we'll be down 0.1 ETH. OpenSea also takes a cut for facilitating the trade, which is a fixed 2.5%. In total, we'll be down 0.125 ETH. This is why, when calculating the bid price, we want to bid below this, and a little extra. The little extra is our profit margin.

Below is the function I used to fetch information about the contract of the NFT and calculate the bid price dynamically to ensure a profitable trade, no matter the royalty fee:

export default async function getCollectionData(

slug: string,

profitPercentage: number

) {

const {

collection: { primary_asset_contracts, stats },

} = await openseaFetch<CollectionType>({

endpoint: OPENSEA_ENDPOINT.collection,

pathParams: slug,

});

const { name, schema_name, address, seller_fee_basis_points } =

primary_asset_contracts[0];

const { floor_price, count } = stats;

log(´Successfully fetched contract {name}´);

const feePercentage = seller_fee_basis_points / 10000;

// -- Get bid price based on profit percentage of the sell price

// BIDPRICE = SELL - (SELL * PROFITPERCENTAGE) - (SELL * FEE)

const price =

floor_price -

(floor_price * profitPercentage) / 100 -

floor_price * feePercentage;

return {

price: +price.toFixed(5),

floorPrice: floor_price,

feePercentage,

count,

schemaName: schema_name,

tokenAddress: address,

};

}The technical limitations

There are many guards put in place by OpenSea to limit how many bids you can place within a timeframe. Their API was intended to be used by normal people, so they put up limitations to stop mass bidding. This, however, won't stop us, resourceful developers, from finding genius solutions to circumvent these limitations.

There are 4 main variables that limit our ability to rapidly bid on NFTs:

- The IP address of the client

- The API key used by the client

- The amount of Ethereum in the wallet of the client

- Daily quota of daily Ethereum Node requests

1. Exceeding the IP address throttle limit

If you're familiar with what a VPN is, then proxies shouldn't be a hard concept to grasp. You can view it as a middleman between you and the internet.

Let's say you're back in first grade. You have a raging crush on a cute blonde girl in your class named Lily, and you want to send her a love letter confessing your feelings. In classic first grade style, you're shy, and you don't want Lily to know that it's you who sent the letter, so you ask your bestest of friends (let's call him Dave) to deliver it for you. Bare with me here, I assure you it will make sense.

Dave gives the letter to Lily, and as she reads, she blushes and seems to be flattered, but since the letter wasn't signed, she now thinks it was Dave who wrote it since he was the one who delivered it.

In this story, the love letter is the request, Dave is our proxy and Lily is the OpenSea API. You make the request and give the proxy instructions on where the request should go. The recipient of the request will think it is the proxy who made the request, thus allowing us to mask our true identity.

This can then be scaled horizontally to make as many requests with as many proxies as we want in parallel, making it look like different clients making the requests all at once. Imagine an army of Daves going up to Lily to deliver a heartfelt love letter all at once.

Below is a simple demonstration of how we can accomplish this in TypeScript.

Making a normal request:

import fetch from "node-fetch";

const URL = 'https://httpbin.org/ip';

async function getOriginNoProxy() {

const response = await fetch(URL);

console.log(await response.json());

};

getOriginNoProxy();Result:

{ origin: '47.216.122.92' }This API returns my IP address. You can try running the code yourself by pressing the button below. You'll get your current IP address, unmasked in its full glory.

Using proxies:

import fetch from "node-fetch";

import { HttpsProxyAgent } from "https-proxy-agent";

// This is a free proxy that I found.

// It probably won't work for long after I post this article.

const proxy = {

host: "130.41.41.175",

port: 8080,

};

const agent = new HttpsProxyAgent(proxy);

const URL = "https://httpbin.org/ip";

async function getOriginWithProxy() {

const response = await fetch(URL, { agent });

console.log(await response.json());

}

getOriginWithProxy();

Result:

{ origin: '130.41.41.175' }As we can see here, the server I'm making a request to thinks the request is coming from the IP address I specified in the httpsAgent, not my actual IP address which we saw above.

But now we have accomplished what we had before, just one more layer. The real power of proxies comes into play when we rotate them. Below we have an array of proxies and put the code we already have in a simple loop.

Rotating proxies:

import { HttpsProxyAgent } from "https-proxy-agent";

import fetch from "node-fetch";

const proxies = [

{ host: "185.212.205.106", port: 59110 },

{ host: "185.212.205.231", port: 59110 },

{ host: "185.212.205.110", port: 59110 },

{ host: "185.212.205.232", port: 59110 },

{ host: "185.212.205.111", port: 59110 },

{ host: "185.212.205.230", port: 59110 },

{ host: "185.212.205.235", port: 59110 },

{ host: "185.212.205.114", port: 59110 },

{ host: "185.212.205.236", port: 59110 }

];

const URL = "https://httpbin.org/ip";

async function getOriginWithRotatingProxies() {

for (let x = 0; x < proxies.length; x++) {

const { host, port } = proxies[x];

const agent = new HttpsProxyAgent({ host, port });

const response = await fetch(URL, { agent });

console.log(await response.json());

};

};

getOriginWithRotatingProxies();Result:

{ origin: '185.212.205.106' }

{ origin: '185.212.205.231' }

{ origin: '185.212.205.110' }

{ origin: '185.212.205.232' }

{ origin: '185.212.205.111' }

{ origin: '185.212.205.230' }

{ origin: '185.212.205.235' }

{ origin: '185.212.205.114' }

{ origin: '185.212.205.236' }That was pretty easy, wasn't it? But making requests to an API that just returns an IP address isn't very useful. This is where the OpenSea SDK comes in.

Finding where to implement the proxy logic was surprisingly easy. After digging for some time I finally found the private method _fetch that is utilized by all the functions of the SDK to call the API.

Bingo. Change the code here, change it for the whole project.

import { HttpsProxyAgent } from "https-proxy-agent";

import { ProxyType } from "./data";

export default function dynamicProxyAgent(proxy: ProxyType) {

return new HttpsProxyAgent({

auth: "USERNAME:PASSWORD",

host: proxy.host,

port: proxy.port,

});

}

...

private async _fetch(apiPath: string, opts: RequestInit = {}) {

const apiBase = this.apiBaseUrl;

const apiKey = this.apiKey;

const finalUrl = apiBase + apiPath;

const finalOpts: RequestInit = {

...opts,

headers: {

...(apiKey ? { "X-API-KEY": apiKey } : {}),

...(opts.headers || {}),

},

// This is where I implemented the proxy logic

agent: dynamicProxyAgent(

proxies[Math.floor(Math.random() * proxies.length)]

),

};

this.logger(

´Sending request: {finalUrl} {JSON.stringify(finalOpts).substr(

0,

100

)}...´

);

const fetchResponse = await fetch(finalUrl, finalOpts);

return await this._handleApiResponse(fetchResponse);

}

...Note: A big caveat to proxies is that the proxy provider can see all the traffic routed through their service. This can be a huge security concern. There are both free proxies and paid proxies. Like all things in life: if it's free, you're the product.

The company behind the free proxies aren't just nice people who want to make the internet a safer place. They store the traffic routed through their service and sell the data to the highest bidder. I recommend you never use a free proxy when making requests containing sensitive information.

Making bids in OpenSea specifies a private API key, your Ethereum wallet address, and your mnemonic phrase. The type of stuff you do not want other people to see. Therefore, should you try this yourself, you should look into using a paid service.

I searched around and tried a lot of different services. I eventually landed on a shoddy service that I will not name due to a lack of better alternatives. What I eventually found is that the company behind the service is Russian. Keep in mind that this was when the Ukrainian war had just started.

While using their service it crashed and it was down for a few days. I contacted their support and they, in not as many words, told me that it was due to the sanctions of their country.

A little later they fixed the issue and offered me a free coupon. I, naturally, gracefully accepted. The Russians are also suffering from this ridiculous war. I may be wrong, but I doubt this shoddy company is in bed with Putin and his oligarchs, so hopefully I'm helping them out by using their services. Best of all, my conscience is clear!

You may have your little war going on, Putin, but I'll be damned if it's going to stop my bot.

2. The API keys

If you're not familiar with API keys, think of them as the login credentials to your Netflix account. If you forgot your password, you're not watching that last season of Grey's Anatomy.

When it comes to API keys on OpenSea, the development team has a full monopoly over who gets a key and who doesn't. Everyone has to fill out a form and wait for the approval. Most people never get their API key. I was lucky enough to get one, however, the rate limit of one key is 4 requests per second. That's abysmally low.

Considering that completing a single bid takes a total of 4 API calls, if I wanted to do a full sweep of a usual collection of 10 000 NFTs, it would take. Drum roll... you guessed it! 10 000 seconds or 2 hours and 46 minutes.

Remember, this is a numbers game, the more nets you throw out into the ocean, the more fish you're going to catch. Spending 3 hours to throw out 10 000 nets may sound like a lot of nets, but in the world of fishing for digital art, this gives us a very low probability of catching anything.

We can do better than that.

"But how?" I hear you say. "OpenSea has a strict limit of 1 key per developer and currently nobody is getting any keys." You worry not, my sweet summer child, for this is where the careless users of the open-source community come in. See, people, by nature, are messy, especially when it comes to storing sensitive credentials.

If you go to GitHub and search OPENSEA_API_KEY you get over 80 pages of open-source code where people are using their API keys. Some have done a good job of keeping their API keys secret, others, not so much.

Write a quick web scraper to go over each page, find the hard-coded API keys, validate them by making a redundant API call to OpenSea, and violà! We now have a lot of API keys to play around with.

When I did this I got a total of 17 keys. This includes some keys that I got from other botters who were in desperate need of the rotating proxy logic. And here I already gave it away for free.

3. The outstanding bid limit

The easiest one to grasp but the hardest one to do anything about is the bid limit. OpenSea set a hard cap on the bids each wallet can have active at once. This is calculated using a dead simple formula:

wallet funds * 10000 > total outstanding bid amountWhat does this mean for us? Let's put it into practice.

If we have a wallet containing 1 ETH, we would have a max outstanding bid amount of 10 000 ETH. If we now run our bot and place bids with a price of 1 ETH on each NFT we would be able to bid on 10 000 NFTs. The way to increase this number is obvious: either decrease the bid price, decrease the bid time so that the offer expires earlier, or put more money in your wallet.

This limitation creates a snowball effect; the more you profit, the more you can bid, the more you can profit, and on it goes. It's a cash-positive feedback loop.

4. The daily Ethereum Node requests quota

So far we've gone over 3 out of for points: rotating proxies, API keys, and the outstanding bid limit.

Last, but not least, we have the nodes you use to talk to the Ethereum network. A single node contains the whole Ethereum network and it is replicated all across other nodes in the world. This is what allows it to be decentralized.

If there is an update to our Node, the other Nodes around the world verify and update. If there is an update on one of the countless other Nodes in the world, our Node verifies and updates. Keep in mind that this is a huge simplification of how the Ethereum network works, however, in broad strokes this explanation will suffice.

In any case, setting up a node for yourself is expensive, hard (unless your name is Vitalik) and time-consuming. A much easier option is to use a provider such as Infura, and use their API. Their service is free for up to 100 000 requests per day. When scaling up my bot I quickly hit this limit.

How should I solve this issue?

Every new user on Infura's platform gets a free 100 000 requests per day. If you can make more accounts, you get more API keys, each with a daily limit of 100k requests.

I used a temporary email service and managed to make a couple of fake accounts all with their own daily quotas. Nice! Now to make many more. I tried automating it, but captchas, anti-bot measures, making fake emails, and saving the generated API key in a database made it a troublesome task, so what to do? I could spend hours manually doing it myself, and I did for a little while. However, this kind of work made my brain smoother by the minute and I stopped. Okay, doing it myself is now off the table, and automating it is not worth the development cost. What now?

I went into a Swedish discord channel and posted the following:

I got a lot of DMs. In retrospect, I think I might have overpaid, but I felt the work was so tedious that nobody would do it for less. In any case, I found a good candidate, and they got to work creating fake accounts and storing the API key. In the end, I had a total of 220 keys which allowed my bot to make a total of 22 million requests per day. This was exactly what I needed.

All the pieces fall into place, except, maybe not?

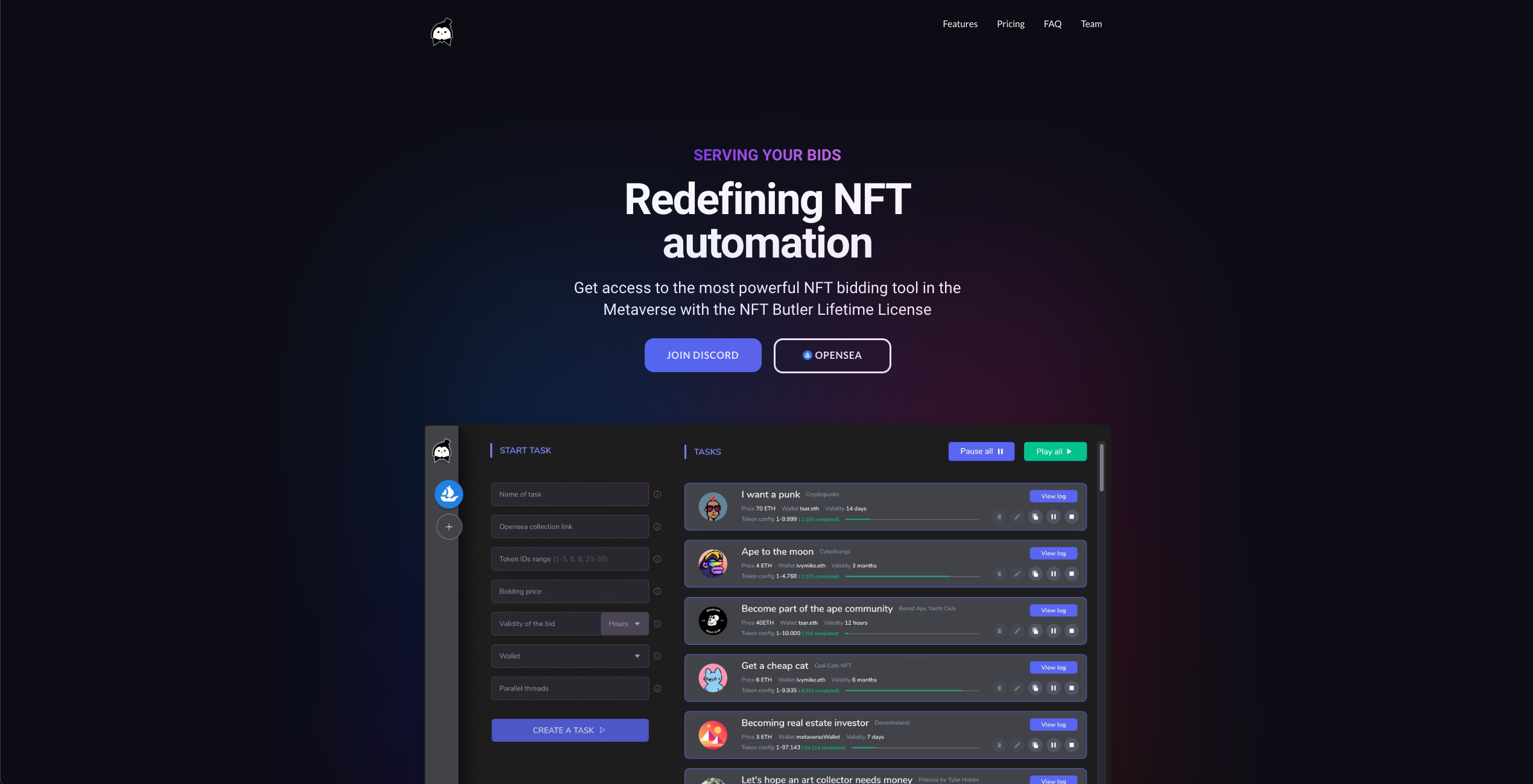

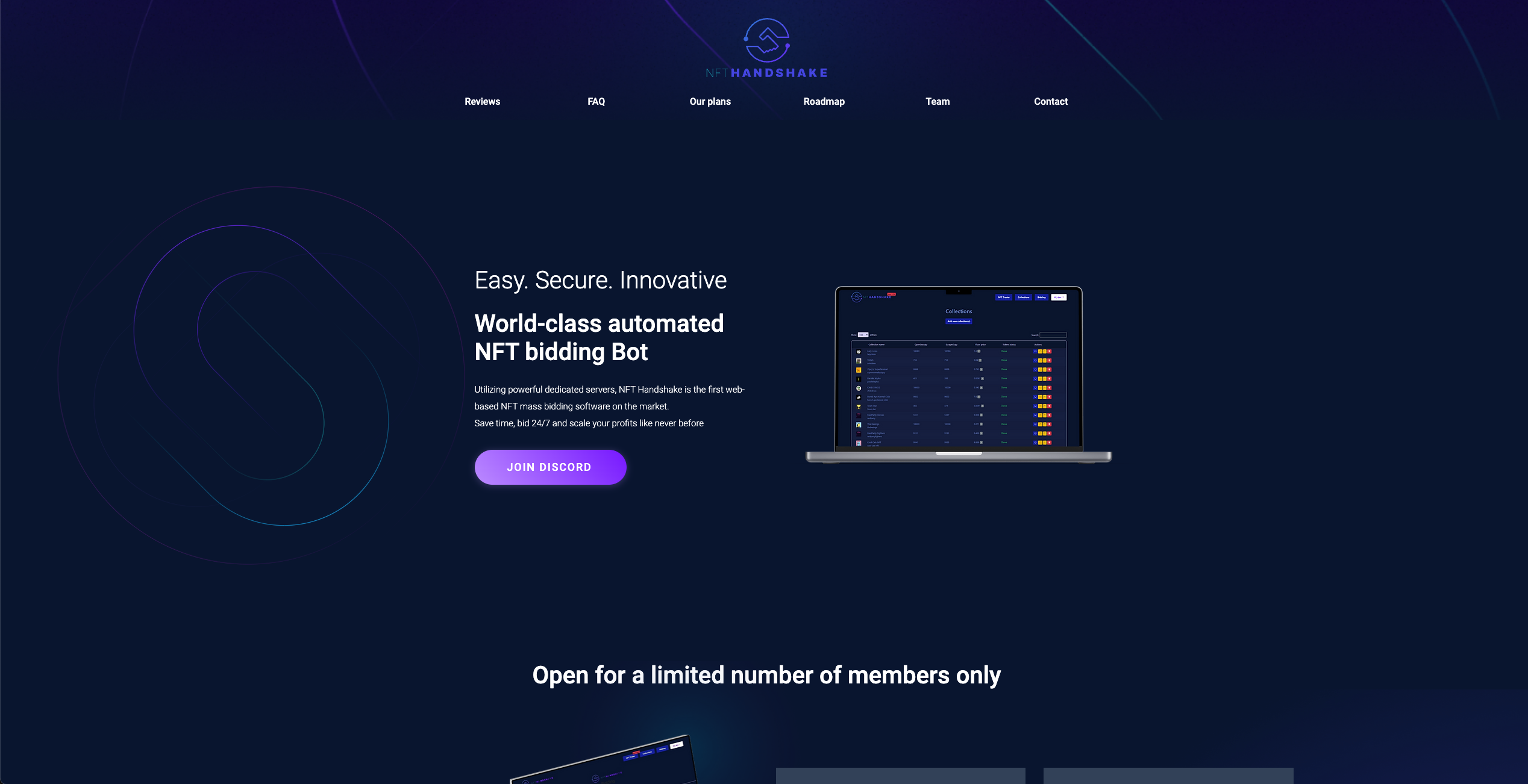

The competition

I was not the first, nor the last to carve out my own niche within the NFT trading space. There was fierce competition. Namely, solutions like NFT Handshake and NFT Butler were the big players. I was just starting out when I found these guys, and my morale was crushed.

I thought that I had no way to compete, and it would be better to just buy access to their service and use that. After doing some more research I realized that this competition was not a disadvantage, quite the opposite; it was a huge advantage. Here are people who share resources, ideas, and their methodology when it comes to bidding for free and then expect you to buy their service.

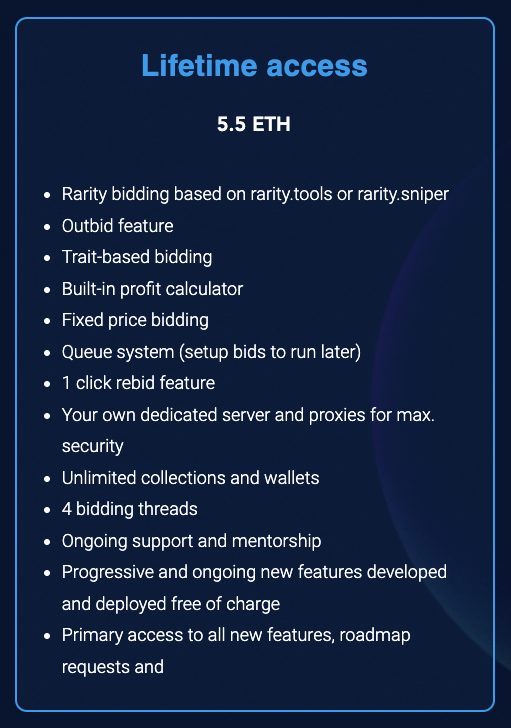

What if I researched their ideas, reverse-engineered their solutions, and implemented them in my bot? Another point that gave me a huge advantage is that these people were good at marketing and selling their services to non-technical people who didn't know code, but their developer team wasn't all that amazing. These are the services they provided:

Mostly just fluff and these insane prices cut into your profit margins if you want to earn something while botting. For reference, at the time, 5.5 ETH was $16 500! Their bots were quite unspectacular. They had a fancy interface, sure, but they could only offer their users a bid speed of around 45 bids per minute.

Don't get me wrong, 45 bids per minute is impressive when you have a large user base, but I could do better.

Imagine a hand-made Ferrari F40 which takes months to manufacture and only one person can drive versus a Volkswagen Golf, which is manufactured in a comparatively short amount of time and reliably serves millions of people every year. Both are good cars in their own respect, but which one do you think would win in a race?

And this was absolutely a race.

The bot in action

With all these variables in place and constant fine-tuning to the code over several months, my bot managed to bid at a rate of 600 bids a minute. Quite the upgrade from the 22 bids per minute I started with. I demolished my competition; Both the hobby developers who coded their own bots and the people who had bought a botting service could not compete.

Of course, they still managed to make money, since there are far too many NFT collections in the world of Web3 to bid on all at once for one bot, however, I was profiting faster than they were. I may have a problem when it comes to my competitiveness.

Competitiveness aside, if we do some quick calculations we can find that my bot ended up bidding on 36 000 NFTs every hour, every day, 24/7. That's over 860 000 NFTs and 3.4 million API requests every single day. All routed through some proxy data center in Spain secretly coming directly from my Linux server at home.

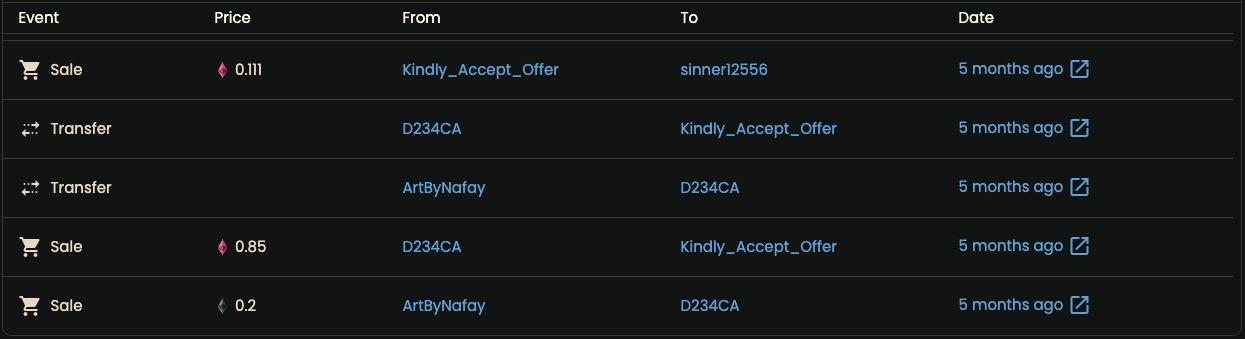

As I mentioned in the first paragraph I managed to lose 0.85 in a single trade. Long story short: in the beginning, I had neglected writing the code to dynamically set the price, and, most crucially, a safety net to stop bids that are way above the floor price to go through. This happened around February, which was when Ethereum peaked at an all-time high of $3 300. The NFT that I lost almost all of my starting capital on was from a collection called Meta legends.

Take a good look at the image above. I paid $2 600 for it. On the NFT we can see the item activity, and here we find the fateful trades which my bot made and the big loss I took.

In the grand scheme of things, it may not seem all that much, and in retrospect, it wasn't. However, at the time, this was the biggest loss I had ever made in my career and I seriously considered stopping working on the project. I subsequently gave myself a day to reflect on the situation. My bot was just starting to gain traction and I was sooo close to having it almost run without any human intervention.

I decided against shelving the bot; like hell if I would let this stop me. The loss wouldn't have been the money that I lost, the real loss would have been if I let this setback stop me. I learned from my mistake, and coded up a safety net to ensure this could not happen again:

import { HARD_MAX_BID_PRICE, HARD_MIN_BID_PRICE } from "../consts";

import log from "./log";

export type SafetyNetParamsType = {

price: number;

floorPrice: number;

feePercentage: number;

BID_MINUTES: number;

};

export default function safetyNet({

price,

floorPrice,

feePercentage,

BID_MINUTES,

}: SafetyNetParamsType) ´

if (price >= floorPrice * (1 - feePercentage))

throw new Error(´{price} is not profitable´);

if (price >= HARD_MAX_BID_PRICE)

throw new Error(´{price} over the max bid price ({HARD_MAX_BID_PRICE})´);

if (price < HARD_MIN_BID_PRICE)

throw new Error(´{price} under the min bid price ({HARD_MIN_BID_PRICE}´);

if (BID_MINUTES >= 25 * 60) throw new Error("bid too long");

if (BID_MINUTES < 15) throw new Er´or("bid less than 15 minutes");

log(´Price of: {price} compliant´);

}I tested my bot more rigorously, invested more money, and kept my eye on the ball. I was now all in.

In retrospect I am extremely glad I made this decision, and it was a great learning experience and I ended up recuperating my loss, and then some.

After this, I made constant minor improvements to the bot, almost like a mechanic tinkering on the engine of his car. It was a hugely rewarding project for me. Improving the bot and instantly seeing the result in the form of profit gave me an incredible work ethic.

The bot dashboard

I previously kept a track of all trades in a Google sheets document, but it quickly became unmanageable as the bot gained traction, so I coded up a quick overview which is on this very site. Look up at the navigation and see the "Bot" tab. The code for which can be seen here:

In conclusion

The way my journey is detailed in this article makes it sound like the road was clear cut: it was not. It was shrouded in a thick fog of uncertainty. I made a lot of mistakes, learned, and grew. Both in business, but also in technical ability. I was constantly optimizing the code and the infrastructure on which it ran and thinking of new solutions. The bot started from a prototype making 22 bids per minute to a whopping 600 bids per minute or 864 000 bids per day.

Eventually, the price of Ethereum dropped, the hype for NFTs fizzled out, OpenSea made breaking changes to their SDK and APIs, API keys stopped working. I moved to my own apartment, I started working at a new company and I had other projects in the making which all took up a significant portion of my time and energy. I decided to stop around the middle of May.

There is more to this story than what I have written here, such as methods to find the best collections to invest in, how to get a high cash flow and how the underlying code worked. I'd like to share more, but this article became much longer than I initially expected.

Botting and trading NFTs is still very much a viable way to make money. While I wrote this article I researched the market and other botters are still thriving, making their owners rich.

I have considered several times picking the bot off of its shelf and start working on it again, but I simply haven't dedicated the time to it. Perhaps someday I will do it, however, that will be a tale for another time. Maybe I'll even release the full source-code some day.

There are so many new exciting things to learn and new projects that can make you money - start building!

If you have any questions, please feel free to contact me.